Fed’s Final Rate Decision of 2024: Why It Matters

Rate cut or hold? FedWatch Tool shows 97.1% odds of a cut. Explore potential market impact and scenarios on DXY, and Stock Market.

The Federal Reserve is gearing up for its last Federal Open Market Committee (FOMC) meeting of the year, set to take place on 18 December 2024.

At the heart of the discussion: the Fed Funds Rate, which influences borrowing costs, economic activity, and market sentiment worldwide.

With the Fed’s policy decisions shaping everything from mortgage rates to global currency markets, this meeting could signal how the economy will perform as we head into 2025. Will the Fed maintain its current course, opt for a rate cut, or deliver a surprise move?

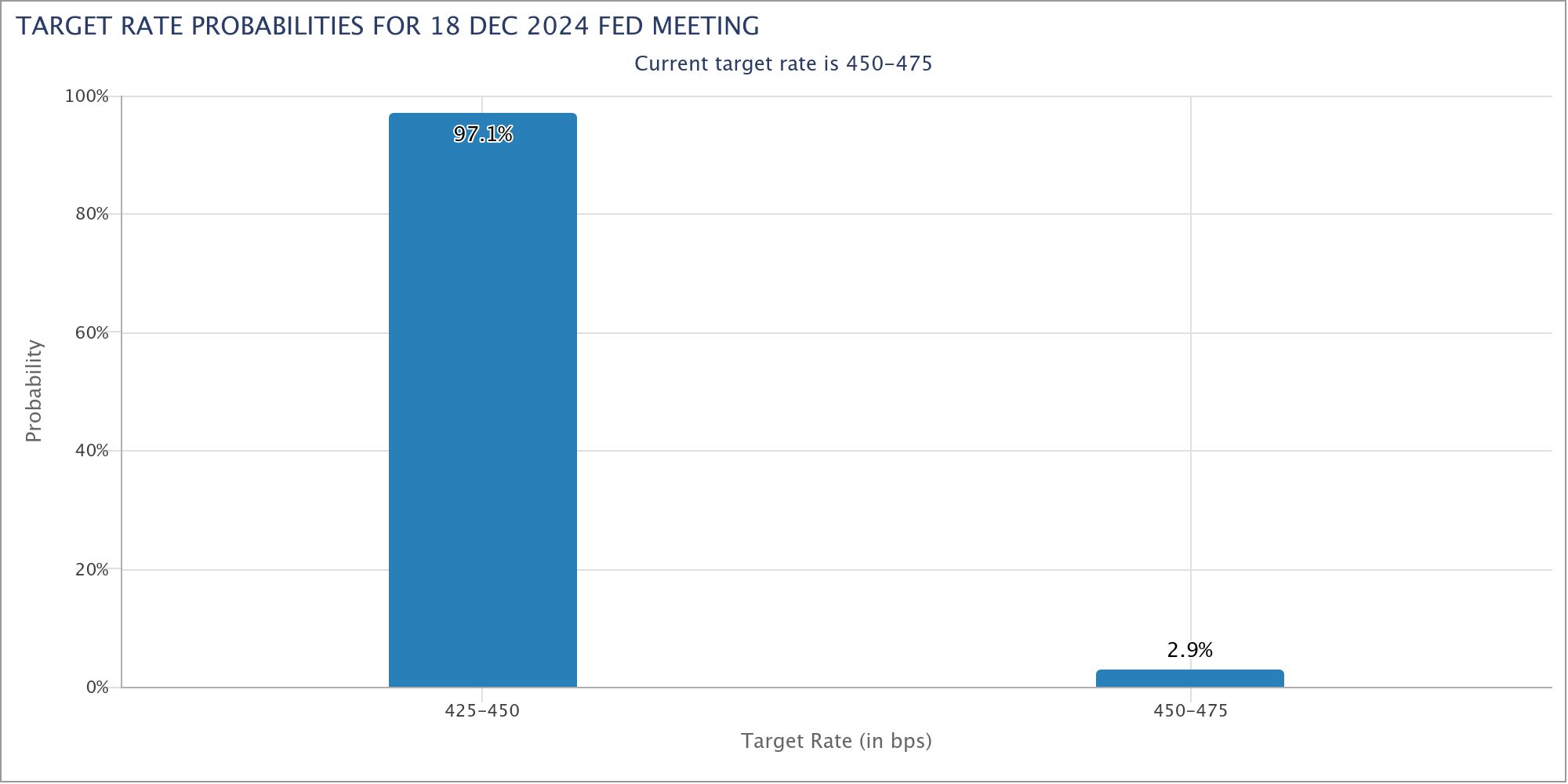

Market Sentiment: The Numbers Speak

As of 16 December 2024, the CME FedWatch Tool, a key resource for market participants, shows the following probabilities:

- 97.1% probability of a 25 bps cut to 4.25%-4.50%.

- 2.9% probability of holding steady at 4.50%-4.75%.

Markets are anticipating a rate cut, but not everyone’s convinced. If the Fed defies expectations, brace for some serious market turbulence.

How the FedWatch Tool Works

The CME FedWatch Tool deciphers data from 30-Day Federal Funds futures to estimate the probability of rate changes. By analysing market pricing, it calculates the odds of potential outcomes, giving traders a real-time gauge of sentiment.

Why It Matters

When the FedWatch Tool points to a likely rate cut, stocks often rally as traders bet on cheaper borrowing costs. If a rate hike seems probable, investors may pull back, expecting tighter financial conditions-a classic case of “buy the rumor, sell the news.”

When Markets Get Shaken

Market turbulence hits when the Fed’s decision catches traders off guard. If a rate cut is expected but a hike happens instead, stocks can drop, and currencies may swing as investors rush to adjust. Volatility spikes—and so do opportunities for those ready to act.

Smart traders don’t just follow the FedWatch Tool -they plan for all possible outcomes. While understanding its signals is key, being prepared for surprises is what separates winners from the rest in a fast-moving market.

Current Interest Rates Comparison

| Currency | Current Rate | Stance | Bias |

| USD | 4.75% | Cautiously favoring rate cuts | Bearish USD |

| EUR | 3.00% | Dovish, favoring cuts | Bearish EUR |

| GBP | 4.75% | Dovish, recent rate cut | Bearish GBP |

| AUD | 4.35% | Hawkish, holding rates steady | Bullish AUD |

| NZD | 4.25% | Neutral, monitoring data | Neutral |

| JPY | 0.10% | Hawkish, Favouring Hikes | Bullish JPY |

| CHF | 0.50% | Neutral, stable rates | Neutral |

| CAD | 3.25% | Dovish, potential rate cuts | Bearish CAD |

What Are the Possible Outcomes?

Scenario 1: The Fed Holds Rates Steady

If the Fed chooses to keep rates at 4.50%-4.75%, it signals confidence that inflation is under control and further tightening isn’t necessary. This decision would align with the broader expectation of stability.

Market Implications:

- Equities: Sectors like technology, which are sensitive to interest rates, could see a lift.

- Bonds: Yields may stabilise, offering a predictable environment for fixed-income investors.

- Currencies: The US dollar would likely hold its ground, with minimal volatility in major currency pairs.

Scenario 2: A 25-Basis-Point Rate Cut

A cut to 4.25%-4.50% would indicate concern over slowing economic growth or labour market softening. While lower rates typically support equities, they could also raise questions about the Fed’s outlook on economic resilience.

Market Implications:

- Equities:

A rally in risk assets is possible, though uncertainty about the economic backdrop might temper gains. - Bonds:

Lower rates would likely push bond prices higher, benefiting fixed-income traders. - Currencies:

The US dollar could weaken, creating opportunities in cross-border trades.

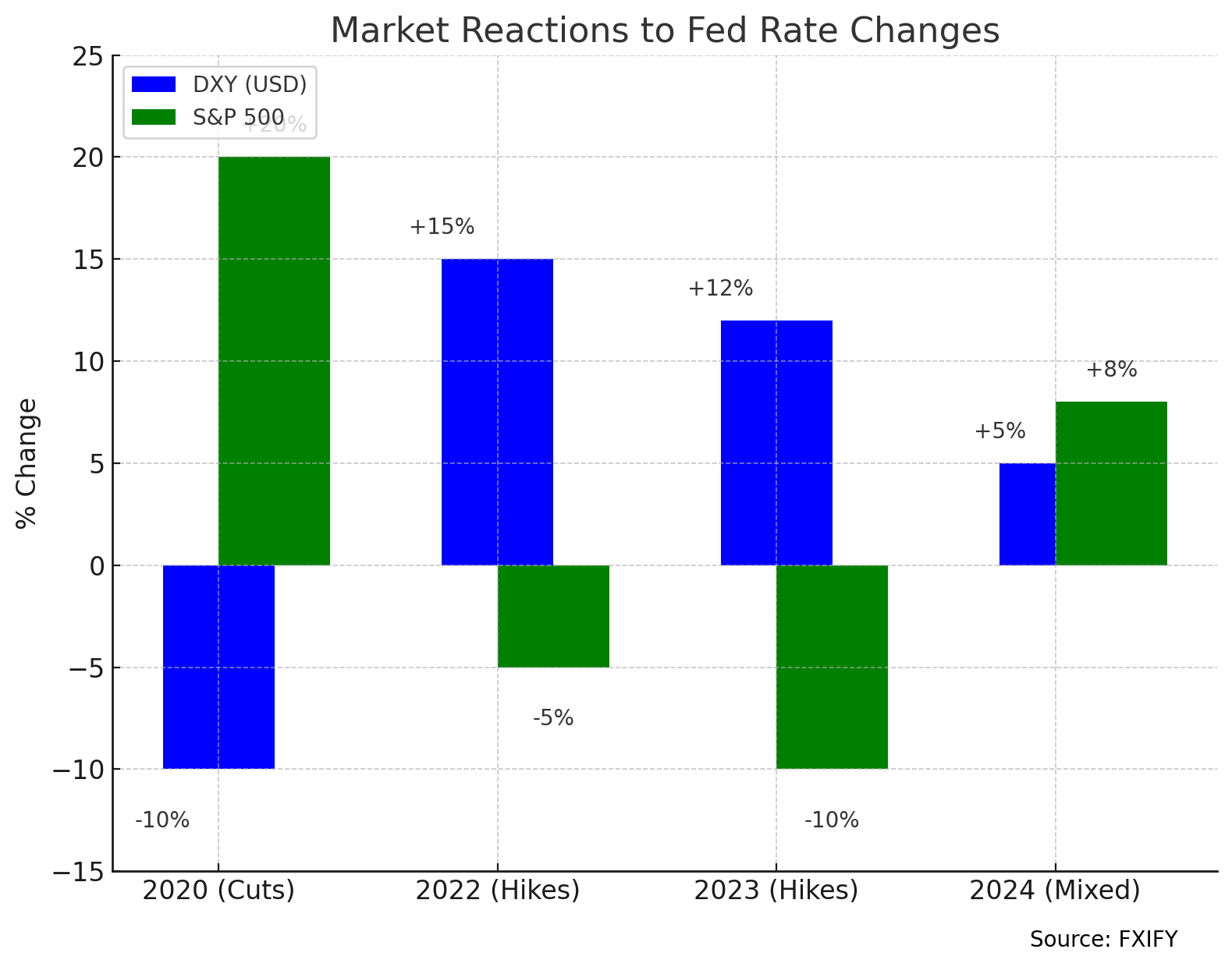

Historical Market Reactions to Rate Changes

Understanding past market reactions to rate hikes and cuts can provide valuable context for traders navigating current market conditions.

This chart highlights how the DXY (USD) and S&P 500 reacted to Federal Reserve rate cuts and hikes in key periods. As shown:

- 2020 Cuts: The USD weakened within weeks after aggressive pandemic-driven rate cuts, while equities surged on stimulus expectations.

- 2022-2023 Hikes: The USD strengthened steadily as rate hikes rolled out, while equities faced immediate pressure amid tightening conditions and recession fears.

- 2024 Mixed Environment: Both markets saw modest moves due to uncertainty around the Fed’s policy path and mixed economic signals.

Traders should note that while end-of-year performance can offer a broad perspective, immediate market responses often occur within hours or days of policy announcements. These reactions are influenced by market expectations, the size of the rate adjustment, and the tone of the Fed’s forward guidance. Being aware of these dynamics helps traders adjust their strategies promptly and capitalise on potential volatility following rate decisions.

What Could Influence the Decision?

Although there’s less than a week remaining, the probabilities could potentially shift dramatically. Several factors are at play:

- Economic Data Releases

Key reports, including inflation indicators (CPI, PPI) and employment figures, will provide clues about the Fed’s potential move. - Fed Communications

Remarks from Federal Reserve officials in speeches or interviews often offer subtle hints. Traders will be parsing every word for signals. Adding to the anticipation is the scheduled release of the Consumer Price Index (CPI) data on December 12. If inflation figures deviate from expectations, market sentiment could change rapidly, prompting traders to rethink rate hike probabilities and adjust their strategies accordingly. - Global Developments

Geopolitical events, fluctuations in oil prices, or unexpected slowdowns in international markets could also shape the Fed’s decision.

What’s Next?

The 18 December FOMC meeting is more than just a routine decision – it’s a potential turning point for monetary policy as we head into 2025. Whether the Fed holds steady, cuts rates, or surprises the markets, the ripple effects will be felt across asset classes.

Traders should remain vigilant, use tools like the CME FedWatch Tool to track sentiment, and stay prepared for potential volatility. The countdown has begun – are you ready for the Fed’s final word?