How the Fed’s Decision and GDP are Setting the Tone for 2025

January 2025 is the most critical month for traders. With the Fed’s decision and GDP report shaping market trends, discover why this month matters and how to act.

As 2025 gets underway, January’s economic data is already setting the tone. The spotlight is on two pivotal events—the Federal Reserve’s first interest rate decision and the U.S. GDP report—both set to steer market sentiment and trading strategies in the months to come.

Why is January so Critical?

January is a key indicator for the year’s trading outlook. Market performance this month often provides crucial clues about trends for the rest of the year. Historically, a strong January points to positive annual returns, while a weaker start can hint at challenges ahead.

The absence of the “Santa Claus Rally”—the typical market boost during the last five days of December and the first two of January—can weigh heavily on sentiment. Without this seasonal uptick, a more cautious investor outlook may emerge, potentially stirring up early-year volatility.

The stock market kicked off 2025 on a high note, with the S&P 500 and Nasdaq Composite posting their strongest performance since November 6—the day Donald Trump won the presidential election. Despite December’s fluctuations, optimism remains strong around the incoming Trump administration and Republican-led Congress.

However, the Dow Jones Industrial Average stumbled out of the gate, recording its worst opening since 2016. It tumbled nearly 700 points, down 1.4% for January so far. The selloff was triggered by a stronger-than-expected jobs report, which pushed Treasury yields higher and dashed hopes for near-term Federal Reserve rate cuts.

These mixed signals highlight why January’s market performance demands close attention—it’s a critical compass for shaping trading strategies in 2025.

Let’s dive into how these trends, alongside the Fed’s decisions and GDP data, will set the stage for the year and guide your next moves.

Federal Reserve Interest Rate Decision (Jan 29)

Why It Matters

The Federal Reserve’s first rate decision of 2025 is a high-stakes moment for traders in forex, metals, and crypto markets. This announcement will directly impact USD strength, borrowing costs, and global liquidity.

A hawkish stance, hinting at further tightening, could boost the USD, weigh on gold prices, and strain liquidity in crypto markets.

A dovish tone could weaken the USD, igniting a rebound in risk-sensitive assets.

For traders, this isn’t just another economic update—it’s a signal to reassess strategies, adapt to shifting markets, and seize opportunities by staying up to date with the latest data and market developments.

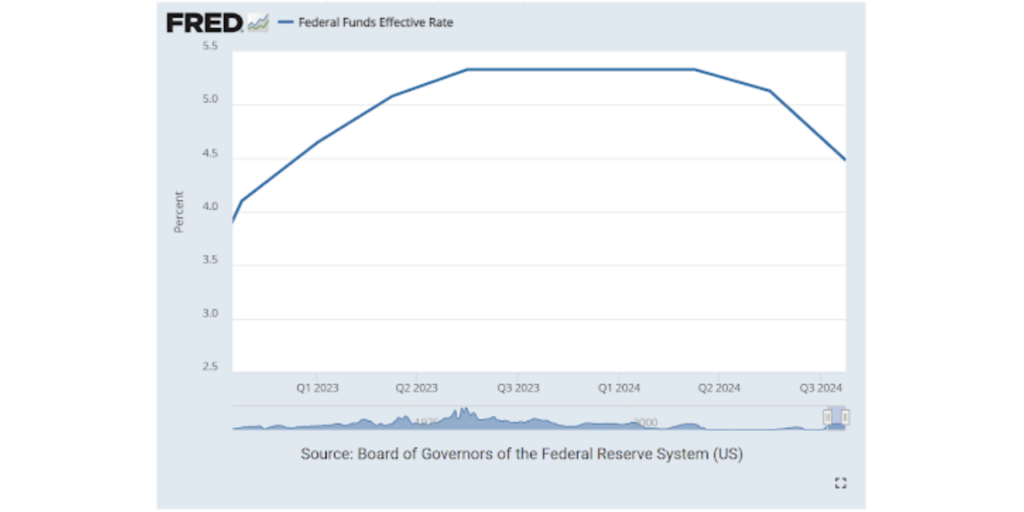

This chart illustrates Federal Funds Rate movements from 2023 to 2024, spotlighting key policy shifts and their impact on market sentiment.

What to Watch

1️. The Fed’s Tone

All eyes are on the Federal Reserve as its tone sets the stage for 2025. Traders will dissect every word from the statement and Chair Jerome Powell’s press conference, searching for clues about the year’s policy direction. Even the slightest change in phrasing could signal a shift in the Fed’s approach, making this a must-watch event.

Key factors to watch in Powell’s tone include:

- Hesitance to Address Rising Inflation: If Powell downplays inflation concerns, markets could take it as a dovish signal. This might weaken the USD and spark rallies in risk-sensitive assets like crypto and metals.

- Confidence in Inflation Control: A message of confidence in managing inflation could reinforce expectations of a rate hold, providing stability for the USD and easing volatility in safe-haven assets like gold.

- Focus on Economic Growth: If Powell highlights slowing growth or labour market challenges, it may signal a cautious stance, leaving the door open for future rate cuts.

Subtle changes in Powell’s wording—whether he leans on phrases like “persistent inflation” or “temporary pressures”—can have a profound impact on market sentiment. Traders should also keep an ear out for unexpected topics during the Q&A session, as these moments often reveal deeper insights into the Federal Reserve’s outlook and potential policy shifts.

2️. Market Sentiment and the CME FedWatch Tool

The CME FedWatch Tool is a go-to resource for traders, providing real-time insights into market expectations ahead of the January 29 rate decision. By analysing 30-day Federal Funds futures, it predicts the likelihood of potential outcomes.

As of January 1st, 2025, the data points to a significant chance of a rate hold:

- Rate Hold: 95.2% chance of rates remaining steady (425-450 bps).

- Rate Hike: 0.0% chance of an increase (450-475 bps).

- Rate Cut: 4.8% chance of a decrease (400-425 bps).

These probabilities help traders anticipate market reactions:

- If a rate hike is expected but doesn’t happen, the USD could weaken, fuelling rallies in risk-sensitive assets like crypto and metals.

- Conversely, an unexpected rate hike might strengthen the USD, putting downward pressure on commodities like gold.

For FXIFY traders, the FedWatch Tool is more than a data source—it’s a strategic asset. By aligning trading strategies with these market insights and preparing for surprises that could drive volatility, traders stay one step ahead.

Potential Scenarios and Market Reactions

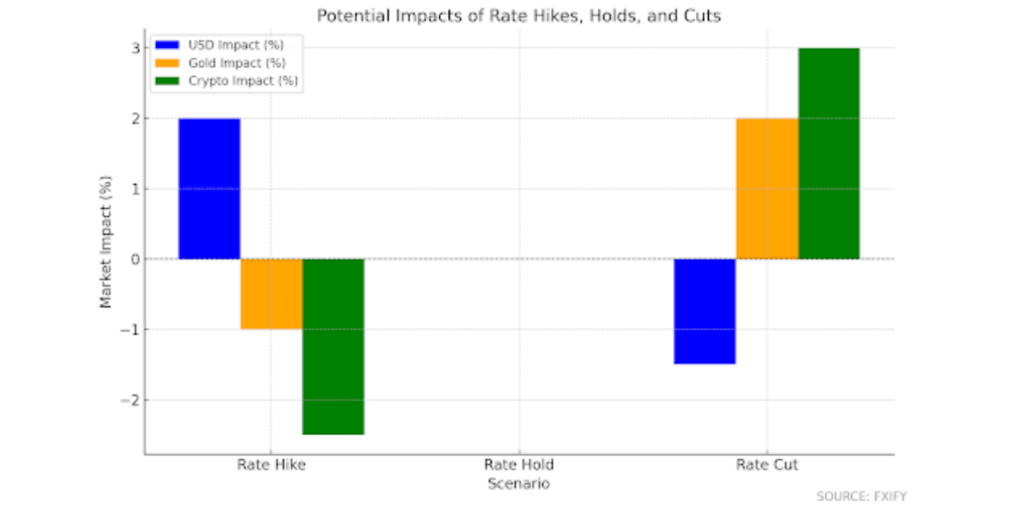

This chart compares the potential impacts of rate hikes, holds, and cuts on USD strength, gold prices, and cryptocurrency markets, helping traders prepare for varied outcomes.

Scenario 1: Rate Hold (95.2% Probability)

- USD: Expected to remain stable with minimal volatility.

- Gold: Likely to trade within familiar ranges.

- Crypto: Limited movement as liquidity conditions stay unchanged.

Scenario 2: Rate Cut (4.8% Probability)

- USD: Weakens, creating opportunities in forex trading.

- Gold: Likely to rally as investors seek safe-haven assets.

- Crypto: Potential for rallies as improved liquidity boosts risk appetite.

Historical trends show that:

- Rate Cuts (2020) Weakened the USD and spurred gains in risk-sensitive assets.

- Rate Holds (2022-2023) Provided stability across markets.

The Fed’s decision will ripple across markets, and traders who prepare for these scenarios will be well-positioned to act on opportunities.

FXIFY™ tools and resources, combined with insights from the CME FedWatch Tool, give traders the edge to navigate these pivotal moments.

U.S. GDP Report (Jan 28)

Why It Matters

The GDP report is one of January’s key economic highlights, offering a clear snapshot of how the U.S. economy performed in the last quarter of 2024. Far more than a mere statistic, it’s a key driver of market sentiment, arriving just days before the Federal Reserve’s rate decision.

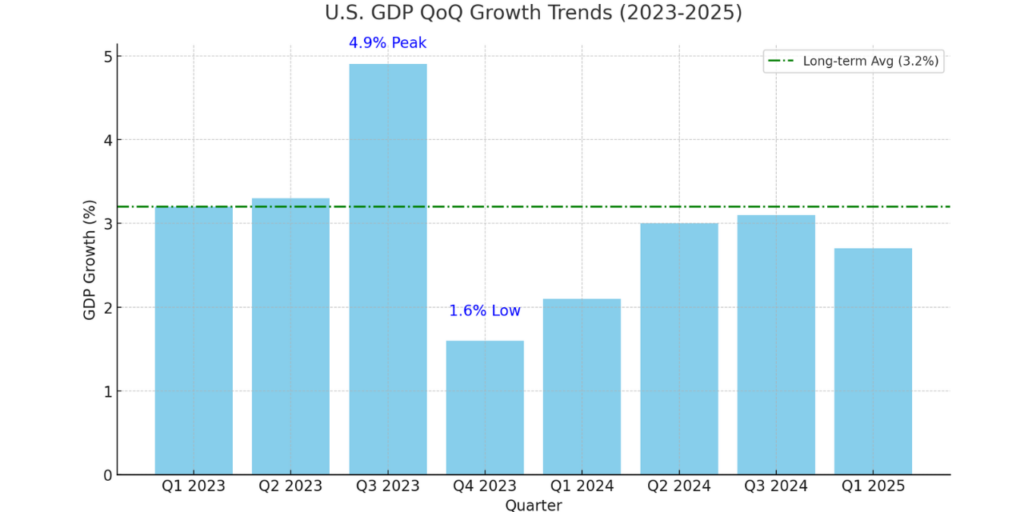

Historical Trends Highlight Their Importance:

Q3 2023: GDP surged to 4.9%, fuelled by strong consumer spending. This growth strengthened the USD while applying downward pressure on commodities like gold.

Q4 2023: Growth plummeted to 1.6%, marking the year’s lowest point, signalling economic cooling and heightened market caution.

Q3 2024: A rebound to 3.1% in the last quarter of 2024, reflecting moderate recovery but still falling short of the Q3 2023 peak.

Q1 2025: Preliminary data for Q4 2024 estimates GDP growth at 2.7% as of January 9, 2025. While offering a snapshot of recent performance, the official Q1 2025 figures are still pending.

The long-term average GDP growth rate of 3.2% is based on historical U.S. economic performance, reflecting the economy’s typical growth over multiple decades.

These trends, as highlighted in the chart, offer crucial context for the January 2025 GDP report. Traders will be closely monitoring the data to determine whether the economy continues its recovery or signals further deceleration—key factors that could shape strategies across forex, commodities, and crypto markets.

What to Watch

- Surprises in Growth: If GDP surpasses expectations, the USD could gain strength. Conversely, weaker-than-expected growth might drive investors toward safe-haven assets like gold.

- Underlying Drivers: Trends in consumer spending and business investment provide insight into the economy’s momentum and hint at the direction of future growth.

FXIFY’s Economic Calendar is a vital tool for staying ahead of high-impact events like the GDP report. Here’s how traders can use it to their advantage:

- Plan Trades: Align your entries and exits with precise GDP release timings to maximise opportunities.

- Anticipate Reactions: Compare actual data against forecasts to gauge shifts in market sentiment.

- Manage Risk: Adjust stop-loss levels, leverage, and position sizes to handle volatility effectively.

By leveraging tools like the CME FedWatch Tool and FXIFY’s Economic Calendar, traders can strategically prepare for these pivotal moments.

How These Events are Interconnected

GDP data and the Federal Reserve’s rate decision are closely linked. Robust GDP growth often reinforces a hawkish Fed stance, strengthening the USD. On the other hand, weaker GDP figures could prompt a dovish approach, leading to a softer dollar and shifts in market dynamics. These connections make understanding both events critical for traders.

Market Implications by Asset Type:

- Forex: USD volatility aligns with shifting rate expectations, creating opportunities tied to Federal Reserve policy signals.

- Metals: Gold moves inversely to rate outlooks—rising on weak GDP and easing with stronger growth.

- Crypto: Liquidity changes driven by Fed decisions inject volatility into risk-sensitive assets like cryptocurrencies.

Understanding these dynamics allows traders to anticipate market trends and seize opportunities.

What Traders Should Do

Prepare for Volatility

- Widen stop-losses: Avoid getting stopped out too early during fluctuations.

- Lower leverage: Adjust your risk exposure to better manage volatility.

- Adjust position sizes: Control your exposure for greater precision and flexibility.

Capitalise on Opportunities

Volatility isn’t just a risk-it’s an opportunity. With the combined tools of FXIFY and CME, you can make the most of these moments:

- Max Lot Size Calculator: Fine-tune your position sizes to match your account’s specifics.

- Performance Protect Add-On: Safeguard gains, even in the face of drawdown breaches.

- FXIFY Economic Calendar: Stay informed about upcoming releases to time your trades effectively.

Pairing a well-defined trading strategy with these resources allows you to turn market movements into actionable opportunities.

The Bottom Line

January’s GDP report and the Federal Reserve’s rate decision are not just economic updates—they are pivotal events that will set the tone for the markets in 2025. For traders, these moments offer significant opportunities for those who are prepared, disciplined, and strategic.

With FXIFY ™ tools and expert insights, combined with resources like the CME FedWatch Tool, you can navigate this crucial month with confidence, using market movements as a launchpad for consistent growth throughout the year.