FXIFY Trade of the Month: January Recap

January’s top FXIFY™ trader turned $400K into a $21,165 win — get a recap on how it happened. Your success story starts here!

Welcome to the first ever FXIFY™ Monthly Recap!

This exciting new series shines a spotlight on you — our community! Find out who were the top traders, key market movements, and standout performances last month.

Kicking off the year with high-impact moves, January has really set the tone for an exciting 2025. Market volatility surged as traders navigated economic data, central bank decisions, and geopolitical shifts. Liquidity spiked as institutions repositioned, driving decisive price action that rewarded sharp execution.

From breakout trades to well-timed reversals, we are thrilled to see our traders capitalise on opportunities, proving that precision and risk management remain essential.

Let’s dive into the standout performances, key trades, and biggest payouts that defined January 2025.

Top 5 Payouts of the Month

Our top earning traders last month were Martim, Ali, Pooja, Nahomy, and Muhammad. Congratulations!

| Rank | Username | Account Size | Payout Amount | Biggest Win |

| 1 | Martim D. | $400K – Two Phase – RAW | $49,500 | $10,696 |

| 2 | Ali R. | $400K – Two Phase – ALL IN | $26,207 | $4,700 |

| 3 | Pooja K. | $200K – Two Phase – RAW | $26,187 | $2,244 |

| 4 | Nahomy R. | $400K – Two Phase – RAW | $22,423 | $5,090 |

| 5 | Muhammad Z. | $200K – Two Phase – RAW | $21,701 | $3,024 |

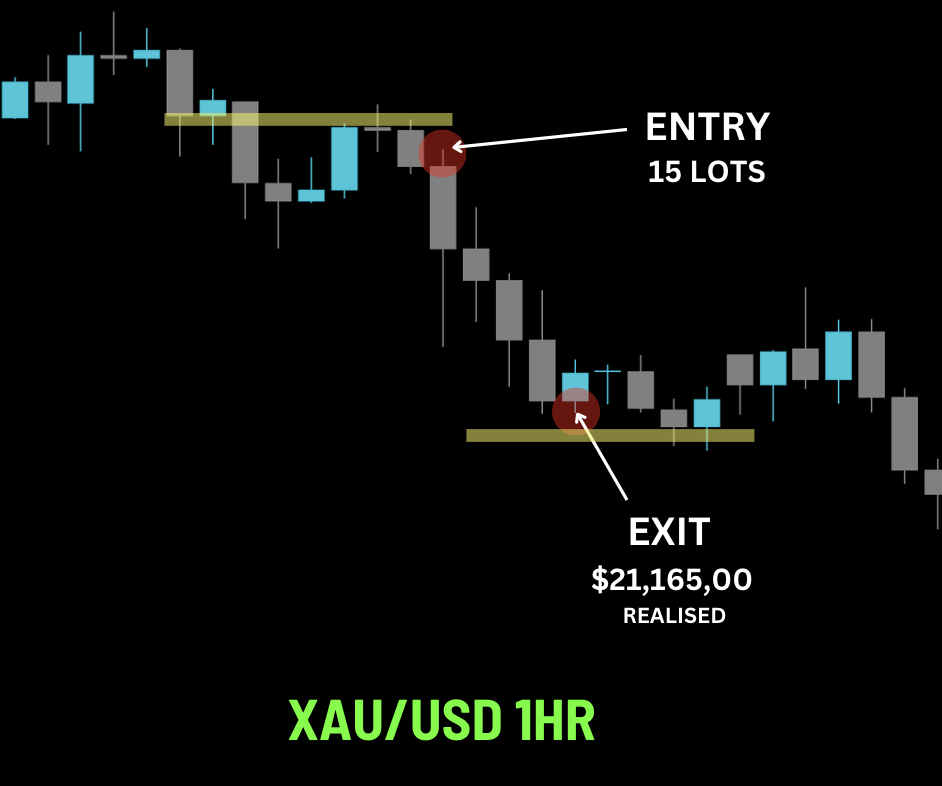

Trade of the Month: Gold Short Setup on XAU/USD

January’s standout trade was a precisely executed short on XAU/USD, securing a $21,165.00 gain in just 3 hours and 32 minutes. FXIFY trader Zaid capitalised on a high-probability reversal setup, demonstrating sharp execution and disciplined risk management.

| $21,165,00 Gain Realised | XAUUSD Pair Traded | 3 HRS 32 MIN Holding Time |

This trade was built on a well-defined trend reversal at a key resistance level. Zaid entered short following a clean break and retest, reinforced by a double-top rejection and bearish engulfing confirmation.

The structured approach and conviction in price action allowed for an efficient move from entry to target, securing a high-impact trade in a short holding period.

The chart above clearly illustrates the trade’s execution, showing how Zaid capitalised on a level-to-level setup with precision. Each technical confirmation aligned perfectly to support a high-probability short trade, reinforcing the strength of the setup.

Now, let’s break down the specific components that made this execution so effective.

Trade Breakdown

- Entry: Zaid executed a precisely timed short position following a rising wedge breakout, coupled with a double-top rejection at the previous resistance level.

The entry was taken on the second tap into the rejection zone, ensuring confirmation of the breakout. We also see a Doji candle formation print out on the entry, which would have given Zaid further confirmation and confidence in his trade post-entry. - Exit: First tap into the previous support and rejection zone.

- Risk Management: Stop-loss positioned above the reversal pattern and rejection wicks.

Analysis & Execution:

This trade is demonstrated on the 1-hour timeframe, where Zaid identified a Rising Wedge breakout, combined with a double rejection near a previous support/resistance level within the pattern.

Entry Signal:

- A strong bearish candle at the peak of the wedge signalled initial weakness.

- This was followed by a bearish engulfing candle, confirming that sellers had taken control.

- Volume spiked, reinforcing the strong selling pressure and providing a clear indication of further downside.

- The trader entered as price broke and retested both the wedge and the resistance zone, confirming a double rejection. This secured a powerful short position, with 15 lots committed to the trade.

Zaid’s exit strategy was calculated and structured, leveraging key support and resistance to define an optimal take-profit level. Anticipating price movement rather than reacting to fluctuations, he targeted the previous support level, allowing the trade to play out as expected. Price broke through interim support without hesitation, reaching his take-profit zone and confirming the strength of the setup.

This trade exemplifies how precision and structured execution can yield substantial gains without excessive risk exposure. With a $400K FXIFY live funded account, even a moderate-sized position can generate strong returns when trading high-probability, level-to-level setups.

Above all, this trade highlights the power of simplicity in technical trading. By focusing on clean price action and well-defined levels, Zaid showed that effective trading is not about complexity, but about executing trades when there’s clarity within the charts.

Move of the Month: XAU/USD’s Breakout Rally

Gold dominated January, surging 2,500+ pips and breaking into price discovery mode, consistently printing higher highs. The rally was fuelled by a high-confluence breakout and retest of a key daily resistance, which then flipped into support, reinforcing the bullish setup with higher timeframe confirmation.

A double-bottom formation at this newly established support level provided the momentum needed to propel gold into uncharted price territories. This technical structure acted as a launchpad for the next leg up, allowing price to gain traction and push toward the next major resistance level, which served as a well-defined take-profit (TP) zone. The clean break-and-retest setup followed a classic key level-to-key level execution, delivering 400 pips in gains from breakout entry to TP.

Gold’s high volatility and sensitivity to economic data releases often lead to more pronounced price swings compared to other assets. January’s rally was driven by wider market uncertainties, shifting monetary policy expectations, and geopolitical factors, reinforcing gold’s safe-haven appeal. This move echoed the precision seen in Zaid’s Gold Short setup, the Trade of the Month, but this time on a longer-term directional play rather than a short-side execution.

With gold maintaining its momentum into February, the question remains—will we see further upside into uncharted price territory, or is a correction on the horizon?

| Start Date: | 28th Jan |

| End Date: | 31st Jan |

| Starting Price: | 2736 |

| Ending Price: | 2786 |

| Pip Change: | 400 |

| Percentage Change: | 1.83% |

Top Traded Assets of January

These figures represent the internal trading volume within the FXIFY community, highlighting the most-traded assets among funded traders.

In January 2025, XAU/USD, EUR/USD, and USTEC were the top-traded assets among FXIFY traders. Gold remained a key focus, while major forex pairs and indices continued to attract strong engagement from traders executing both short- and long-term strategies.

| Symbol | Total Trade Volume | % Price Change M/M |

| XAUUSD | $65,028,297,302 | +5.56% |

| EURUSD | $15,811,766,641 | +0.88% |

| USTEC | $10,689,603,324 | +4.27% |

🏅XAU/USD (Gold)

Gold prices surged in January, approaching the significant milestone of $3,000 per ounce. This rally was driven by ongoing geopolitical uncertainties and aggressive trade policies, which heightened gold’s appeal as a safe-haven asset. Additionally, strong demand from central banks, particularly China’s, and increased inflows into bullion-backed ETFs contributed to the bullish momentum.

💶EUR/USD

The EUR/USD pair experienced fluctuations influenced by monetary policy expectations and economic data releases. Market participants closely monitored signals from the European Central Bank and the Federal Reserve regarding future interest rate policies, leading to cautious trading behaviour. Divergent economic indicators between the Eurozone and the U.S. also played a role in the pair’s movements.

📈USTEC (Nasdaq 100 Index)

The Nasdaq 100 Index saw significant activity, driven by earnings reports from major technology companies. Investor sentiment was influenced by company performances and broader market trends, leading to notable movements in the index. Factors such as high valuations and potential regulatory actions also contributed to the index’s volatility.

The Next Top Trader Could Be You!

This month, Zaid crushed it with a rewarding $21,165.00 payout on his $400K trading account, executing the perfect combination of precision, strategy, and bold trading. Performances like Zaid’s set a high bar in the FXIFY™ community, and we’re proud to celebrate such standout achievements.

If you’re looking to take your trading to the next level, let this be the motivation you need. The next big trading success story could be yours!

| Account Type: | 400k |

| Top Asset | XAUUSD |

| Lot Size: | 15 |

| Biggest Win | $21,165,00 |

| Trading Time: | 3hrs 32min 43sec |