In trading, it’s often said that there is Smart Money and Dumb Money.

Smart Money refers to large institutional players like banks and hedge funds. These groups have access to substantial capital and the influence to move markets.

They can operate in ways that retail traders, often called Dumb Money, cannot. Retail traders lack the influential power and financial resources to significantly affect market prices, unlike Smart Money.

Learning Smart Money Concepts (SMC) is intended to help retail traders trade in the same direction as Smart Money and, therefore, follow the underlying trend and pivots in the market. These concepts help us, the dumb money, understand how Smart Money operates so we can align our strategies with the market’s biggest players and better follow their movements.

What are Smart Money Concepts in Trading?

Smart Money Concepts (SMC) is a guiding framework traders use to understand how institutional players like banks and hedge funds operate. These concepts help retail traders anticipate market movements by analysing liquidity, market structure, and price imbalances created by big players.

The name also derives from the belief how there is smart money, and dumb money in the financial market. Smart money refers to big players like banks and hedge funds with resources and market influence, while dumb money refers to retail traders with limited funds and influence.

Understanding Smart Money Concepts

Understanding Smart Money Concepts (SMC) helps retail traders like ourselves learn to swim with the current rather than against it. If you’re trading without understanding how “smart money” moves, you risk swimming against the tide and being swept away.

By mastering SMC, you gain insight into how major players like banks and institutions trade, giving you a market edge.

That said, it’s important to note that while SMC is proclaimed to reflect how institutional traders operate, this idea is debated. Many former institutional traders argue that the concept is exaggerated or inaccurate.

However, SMC has rapidly gained traction in the past few years and remains a widely used approach, with many traders around the world successfully using it.

In this guide, we’ll break down key Smart Money Concepts, so you can start applying them in your trading, even if you’re a beginner.

The Origins of Smart Money Concepts

The theory of SMC originates from classic market cycle theories, namely the Wyckoff Accumulation Theory, created by Richard Wyckoff.

Wyckoff believed that the market moves in cycles, much like the ocean’s changing tides. These cycles move between phases, from an accumulation phase to a distribution phase.

Distribution and accumulation refer to phases in the market where institutions buy or sell large quantities of assets. Think of it like restocking shelves before a big sale (accumulation) or clearing them out (distribution).

‘Markups’ are transition periods where the price sharply moves pivots from accumulation to distribution. ‘Markdowns’ refer to the reverse, where price moves from distribution to accumulation (markdown). Some traders also refer to this as the ‘manipulation’ phase.

These phases create supply and demand zones that influence price action. For example, smart money tends to pick up stocks at demand zones where retail traders may be fearful and sell instead. Conversely, smart money will value selling at supply zones, where retail tends to buy at high prices, giving Smart Money the opportunity to sell.

Understanding these phases can help you anticipate where major market moves may occur.

Traders utilise SMC as a framework to interpret these market dynamics, allowing them to anticipate price action and enter trades in the assumed direction of the smart money. Let’s dive deeper into how traders use SMC to their advantage.

Core Elements of Smart Money Concepts

Smart Money Concepts are made up of five main ideas: Order Blocks, Liquidity Pools, Fair Value Gaps, Break Of Structure (BOS), and Change of Character (CHoCH).

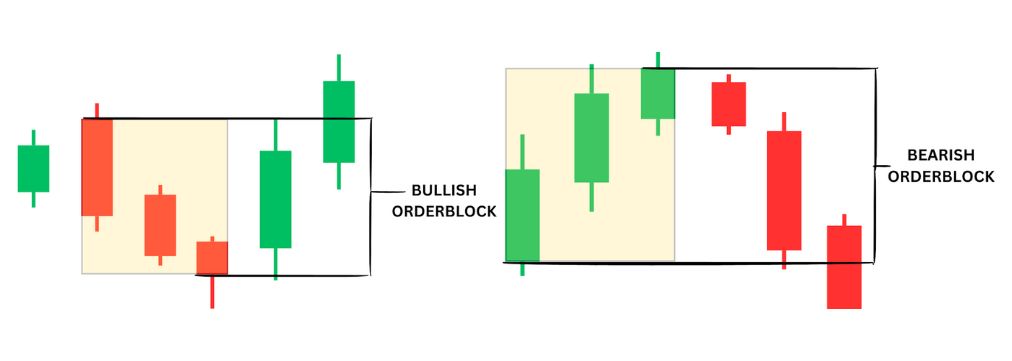

What are Order Blocks?

Order blocks represent zones where large institutions – like hedge funds or banks – have placed significant buy or sell orders. These zones create key areas of support or resistance because institutional players are moving large amounts of money in or out of the market. Price tends to respect these areas, either reversing or pausing at them before continuing in its direction.

How to Identify and Use Order Blocks in Trading

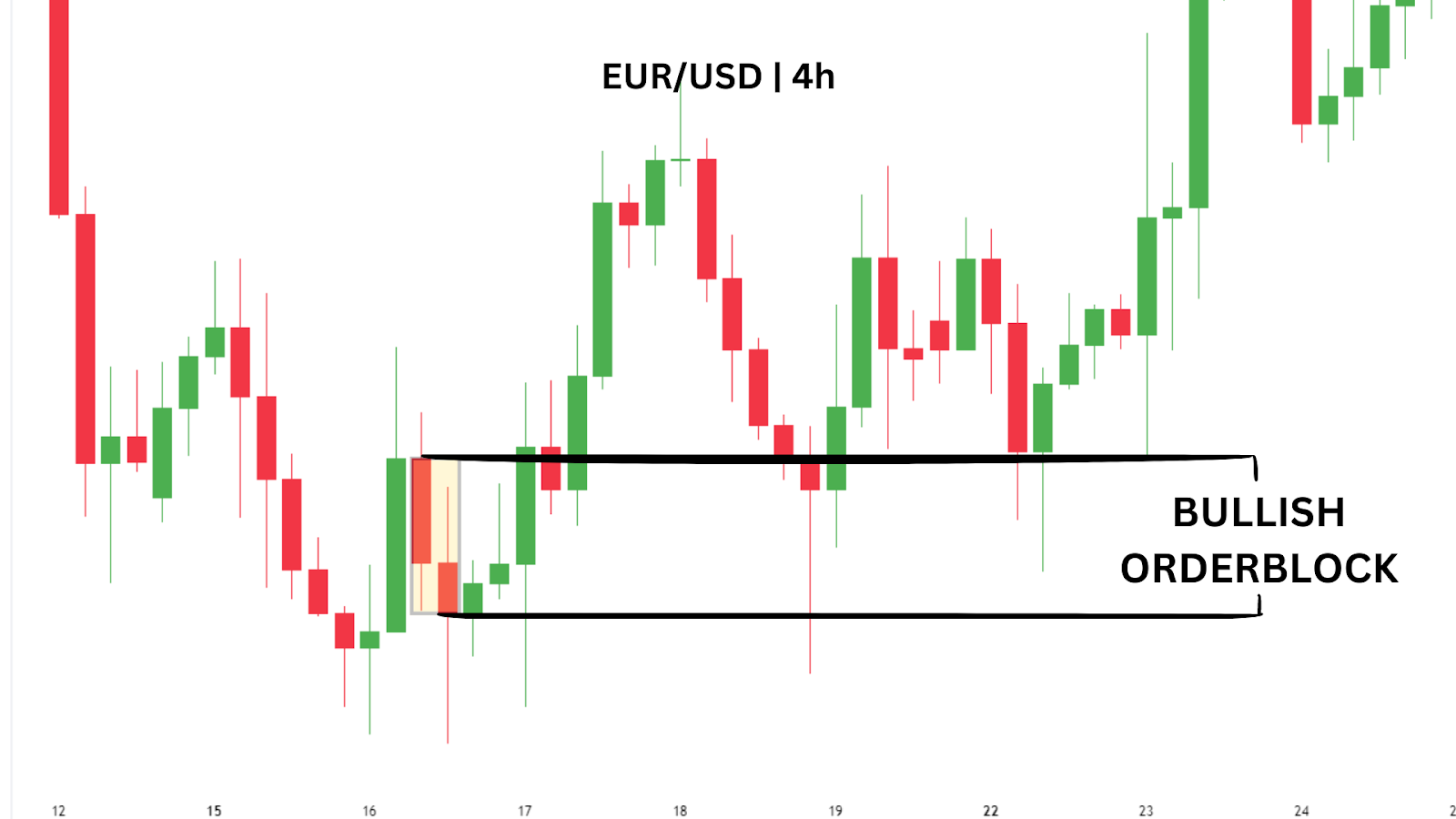

To identify an order block, look for the last bullish or bearish candle before a strong move in the opposite direction. Let’s look at an example on the 4h chart for EUR/USD.

We see two down-closed candles (bearish) take out the low before a sharp reversal. The third candle in this sequence (bullish) closes ABOVE the open of the candle that formed the beginning of the order block.

To establish a bullish order block (support), identify the last bearish candle before a significant price increase—as highlighted by the yellow box. Then, using that candle body close, we will mark out the order block’s range low.

Here’s another example on EUR/USD 4h on April 18, 2024.

Ideally, the order block’s last candle should form the swing low, the lowest point before the market reverses upwards.

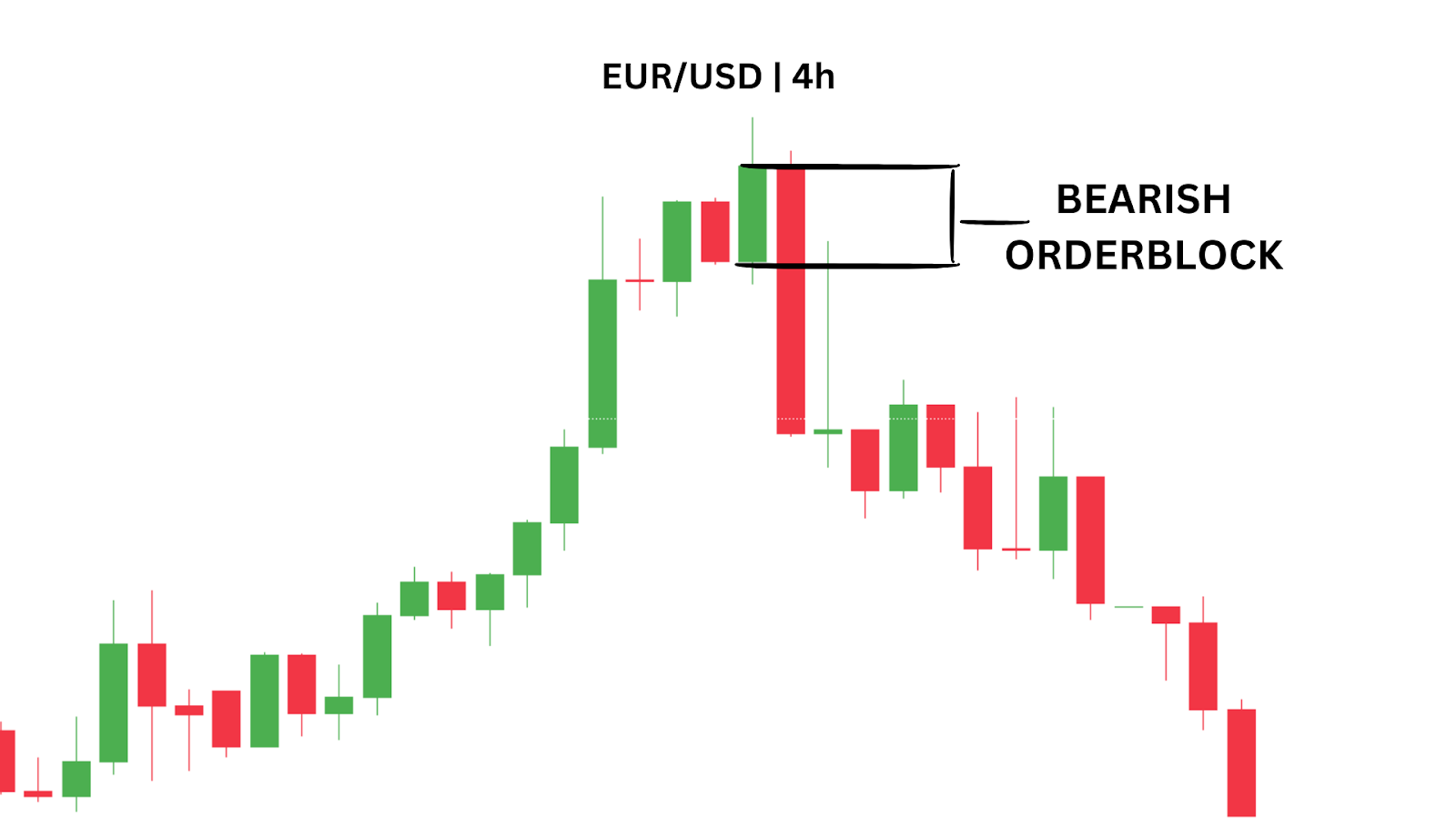

To establish a bearish order block (resistance), find the last bullish candle before a major price drop. Then, use the candle body’s opening and closing prices to mark out the order block’s highs and lows. For example, this bearish order block formed when we had a large bearish candle close below the last bullish candle, as highlighted in the image.

Liquidity Pools/Draw on Liquidity

Liquidity Pools refer to areas in the market where orders are concentrated- often around obvious levels like recent highs, lows, or consolidation zones.

When traders place stop-loss orders around the same levels, it creates a cluster of orders known as a liquidity pool. Institutional traders exploit these pools by driving the price to trigger stop-losses, gaining liquidity, and then reversing the price in their intended direction.

Institutional traders target these areas because they can execute large orders without causing wild price swings.

Strategies to Identify and Trade Liquidity

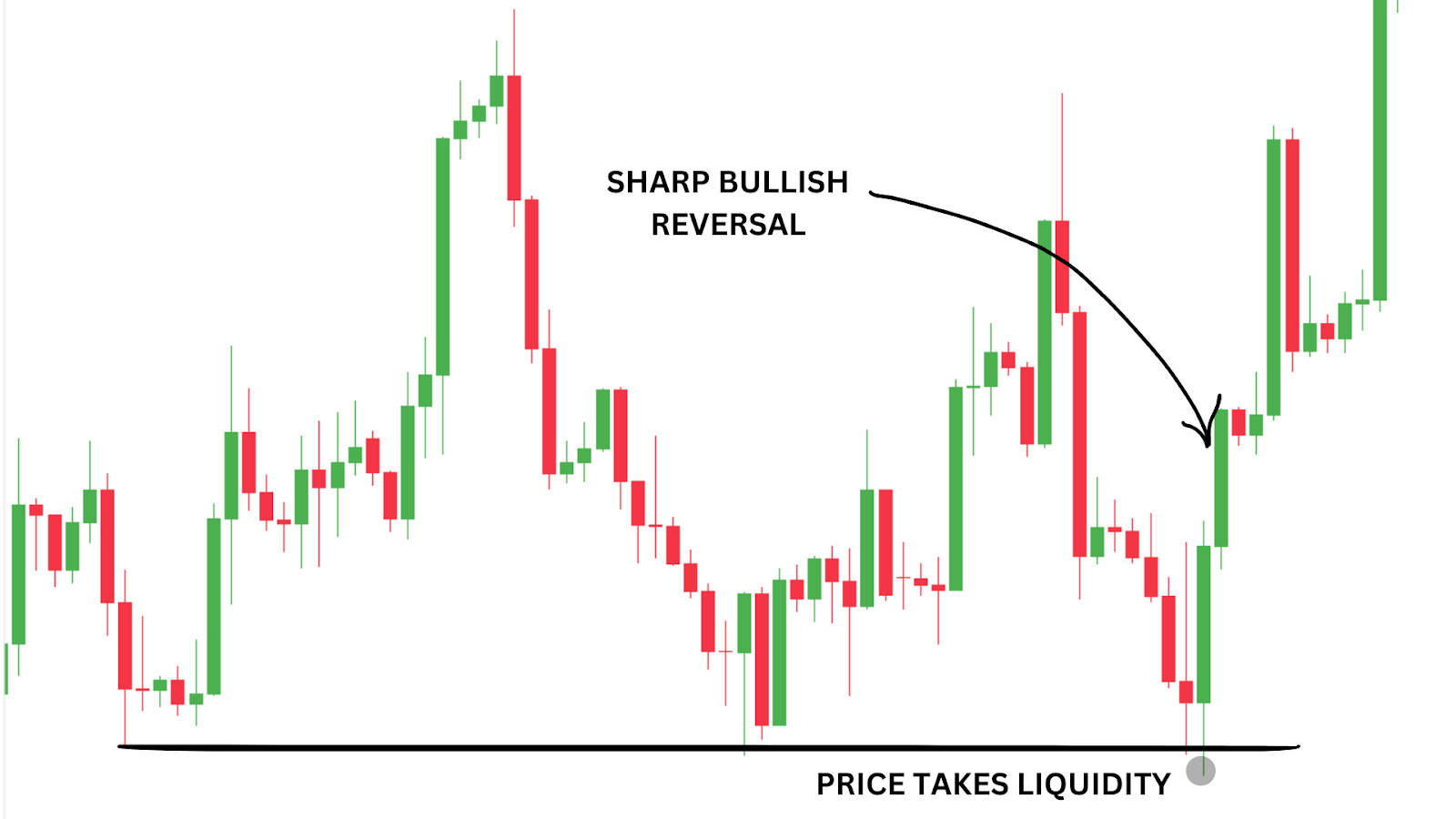

To identify liquidity pools, look for areas where price has previously made sharp movements – often near key highs or lows.

Key Highs are price levels where the market has previously peaked before reversing. Traders often set stop-loss orders just above these levels, expecting the price to fall once it reaches this point again.

Key Lows are price levels where the market has bottomed out before bouncing back. Retail traders typically place stop-losses below these levels, hoping to protect their positions from further declines.

When prices drop to key lows, many retail traders enter a trade and place their stop-losses just below—just like in the previous concept of liquidity pools. Smart money, aware of this, may manipulate prices downward to trigger these stops, creating a liquidity grab.

Once these stops are hit, retail traders are forced to sell, providing opportunities for smart money to buy or enter long positions.

As the liquidity pool is drained, smart money reverses the market direction, often sharply pushing the price back up, leaving retail traders scrambling after being forced out of their trades.

This aggressive move to take liquidity is sometimes referred to as a “Draw on Liquidity” within SMC circles.

This concept tells us to not set your stops at obvious levels; wait until institutional traders have taken the level, and then look for your trade set-up.

Fair Value Gaps

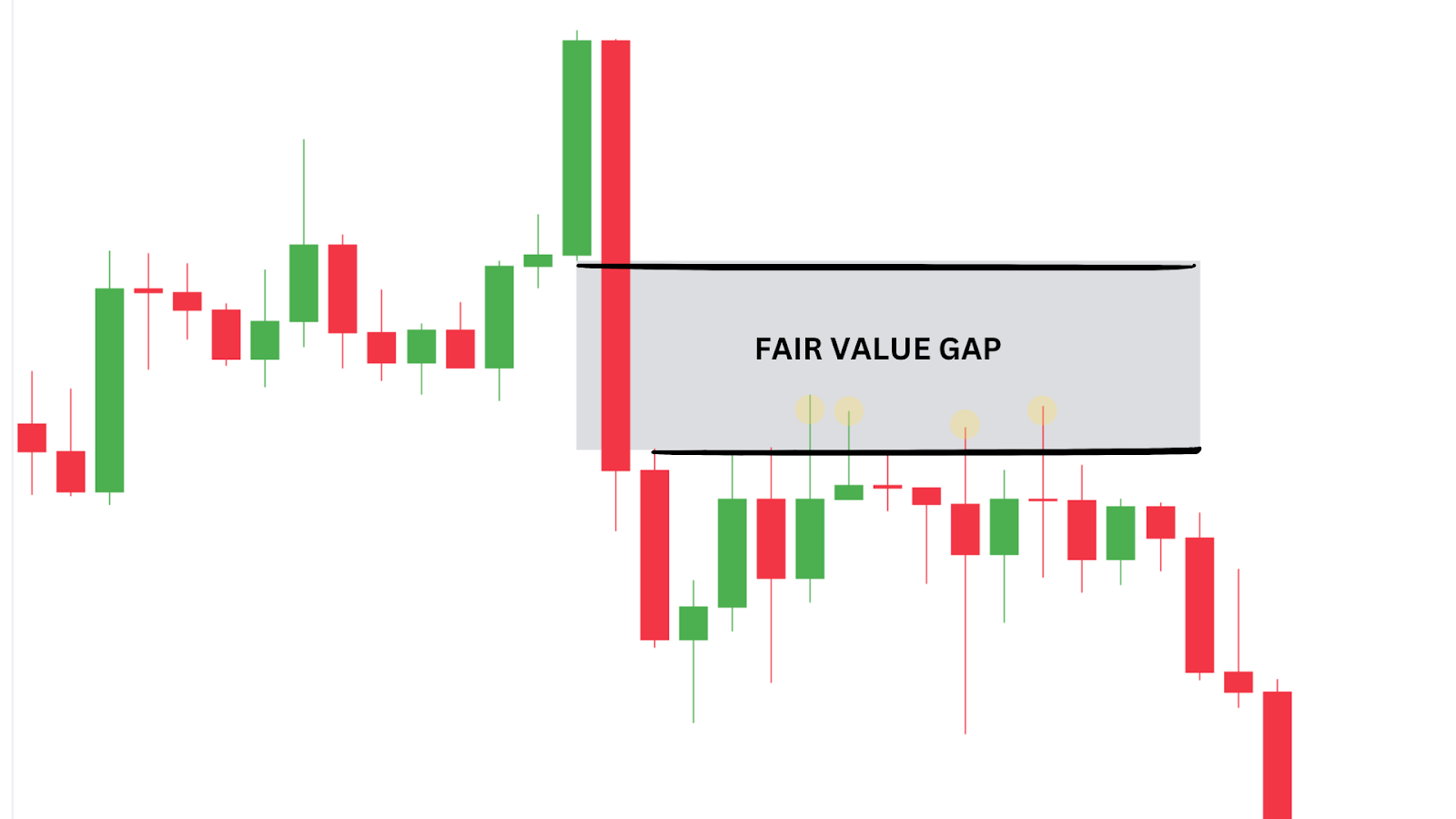

Fair Value Gaps (FVGs) are areas on a price chart where the price moves so quickly that it leaves a liquidity gap. In SMC trading, these gaps are seen as areas of interest for institutional traders, acting as hidden support or resistance zones.

Imagine a crowded street. Suddenly, everyone moves to one side, leaving a space in the middle. That space—the FVG—eventually gets filled as people move back. The same happens in the market: price tends to fill these gaps over time as the market seeks balance.

How to Identify and Use Fair Value Gaps

A Fair Value Gap appears when a candle’s wicks don’t overlap with the previous one, showing an imbalance in buying and selling. A quick tip in looking for a Fair Value Gap is to look for three candlesticks moving towards the same direction, as they have a higher likelihood of forming a gap.

When a Fair Value Gap (FVG) forms after the price moves higher, it is considered a ‘Bullish Fair Value Gap’. Price may return to this gap later to “fill” it before continuing higher. Notice how in the example below, the price retraced to the FVG and did not close below. This signals a potential bounce from the FVG.

In a bearish trend, a fair value gap can appear after a sharp price drop. Price may retrace to fill the gap before resuming its downward move. Notice how the candles following this bearish FVG never close inside—the wicks get rejected four times!

How to Trade Fair Value Gaps

When trading fair value gaps, the idea is to look for price retracements to fill the gap, offering a potential entry point as long as the price does not pierce through the Fair Value Gap with a closing candle.

For example, after spotting a gap in a bullish trend, you could enter a long position when the price starts retracing toward the gap. Set your stop-loss below the gap and target the next swing high or a fixed risk-to-reward (RR) for your take-profit.

Kill Zones and When to Trade SMC Concepts

Smart Money Concepts (SMC) traders often focus on specific market sessions called kill zones. These are periods where there’s heightened market activity, usually due to overlapping time zones of major financial centres, which leads to increased volatility. Traders can use these time windows to sharpen their entries and capitalise on short-term moves.

Due to the increased liquidity and volatility, kill zones are an ideal time for finding precise trade entries with Smart Money Concepts. As institutional players become more active, price movements become sharper, allowing SMC traders to execute better strategies such as liquidity grabs, fair value gap retracements, and order block reactions.

Scalping during these periods is especially effective, as the volatility within kill zones often leads to quicker price swings and more predictable short-term setups. For traders focused on faster timeframes, like 1-minute or 5-minute charts, kill zones offer the best opportunity to capture these rapid price movements.

Below are the kill zones SMC traders like to trade within:

| ASIAN KILL ZONE | 08:00 PM – 10:00 PM (UTC-4) |

| LONDON KILL ZONE | 02:00 AM – 05:00 AM (UTC-4) |

| NEW YORK KILL ZONE | 07:00 AM – 09:00 AM (UTC-4) |

| LONDON CLOSE KILL ZONE | 10:00 AM – 12:00 PM (UTC-4) |

Break of Structure (BOS)

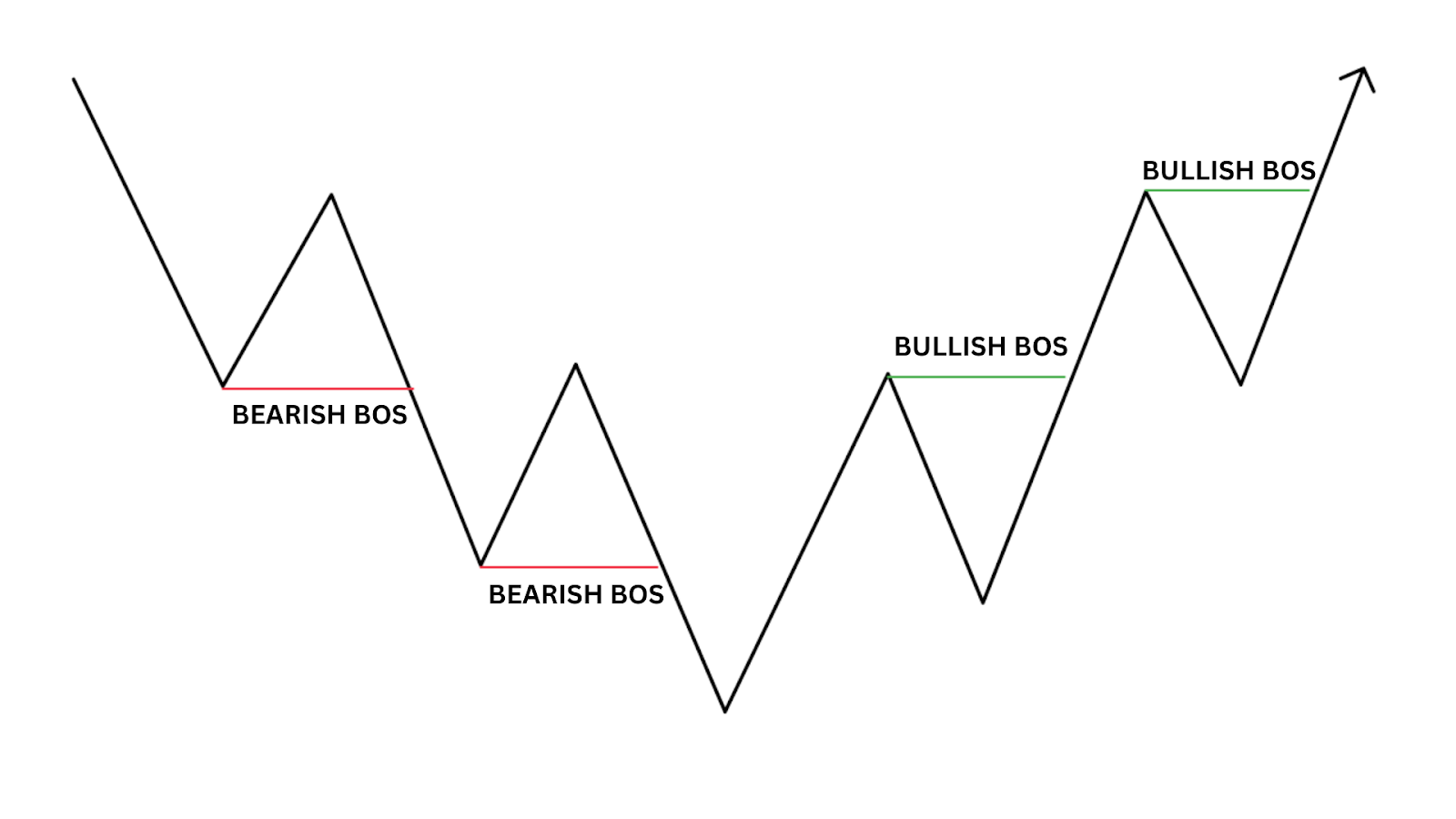

A Break of Structure (BOS) happens when the price breaks past a previous high or low, confirming that the trend is continuing. When a previous high is broken, it’s considered a Bullish BOS. When a previous low is broken, it’s a Bearish BOS.

How to Identify BOS

To identify a BOS (Break of Structure) in an uptrend, look for the price breaking above the previous swing high. This confirms a continuation of the trend. Specifically, wait for a candle to close above the prior high to validate the break. In a downtrend, look for the break below the swing low.

Using BOS in Trading

When you spot a break of structure (BOS), it signals that the market is likely to continue in the same direction. For instance, if the price breaks a previous high in an uptrend, it’s a sign to either hold onto your position or consider entering a new one in line with the trend.

Change of Character (ChoCH)

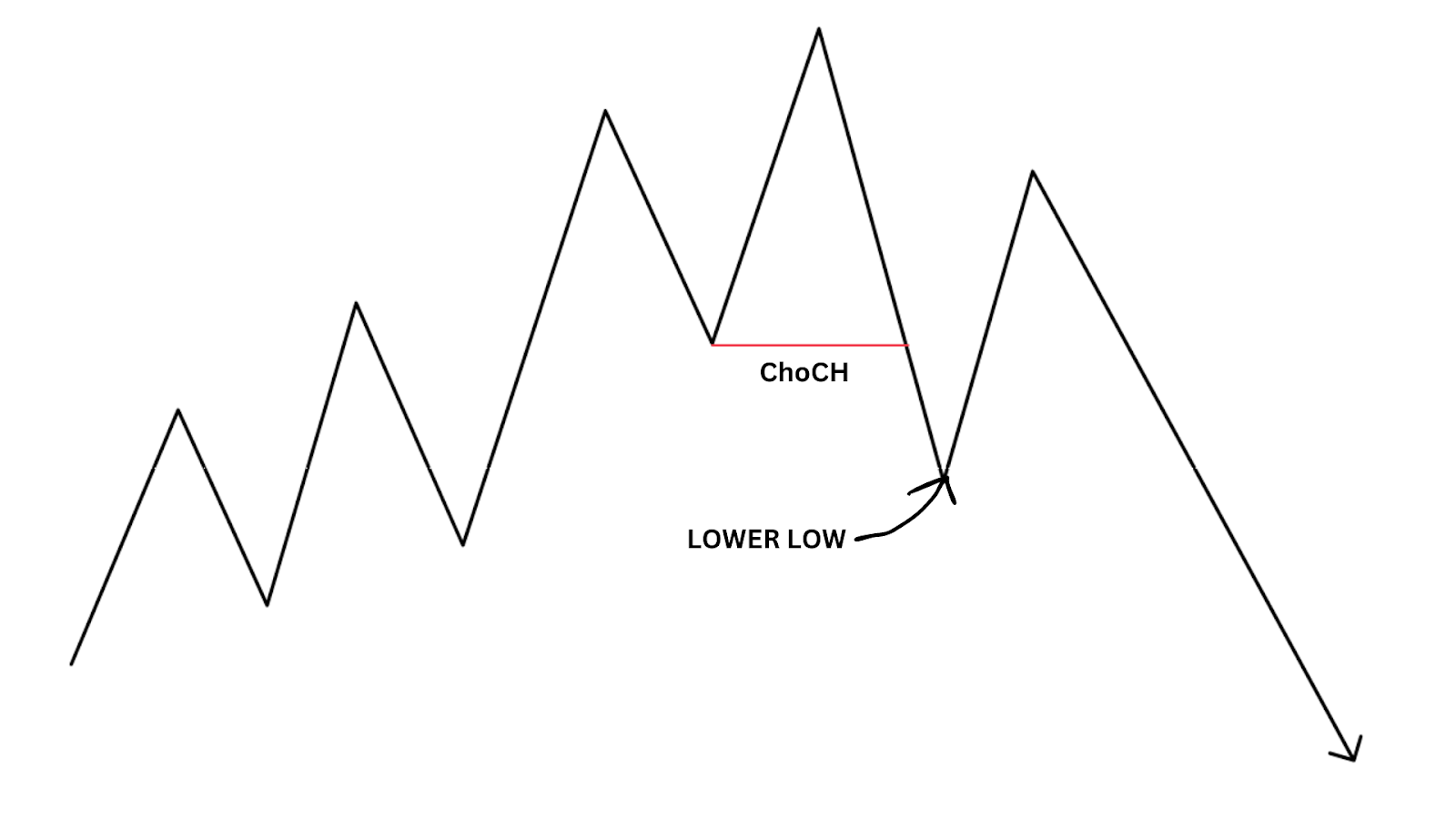

While BOS signals continuation, a Change of Character (CHOCH) signals a potential reversal. CHOCH shows that the market may be losing its current momentum and could be about to change direction.

How to Identify CHOCH

In an uptrend, price makes higher highs and higher lows. A CHOCH occurs when the price fails to maintain that pattern, usually by breaking below a recent low. This is a warning sign that the trend may reverse or move into a consolidation phase. The reverse is true during a downtrend, where the market makes lower highs and lower lows, but a CHOCH occurs when a higher high is created.

Using CHOCH in Trading

A CHOCH signals the potential for a trend reversal, telling traders it might be time to rethink their positions. For instance, if you’re in a long position during an uptrend and see a CHOCH (price breaks below a recent low), it could be time to exit or prepare for a downtrend.

Let’s examine some more advanced strategies SMC traders use to capitalise on future price movements.

How Smart Money Concepts Work Together & How You Can Trade Them

Smart Money Concepts (SMC) aren’t meant to be used all at once in every trade. Instead, they offer flexible tools that traders can combine, adjust, and deploy according to your strategy, timeframe, and asset.

Each SMC concept – like the bullish order block, Fair Value Gap (FVG), or Change of Character (CHOCH) – can individually offer valid entry or exit points. For instance, you might enter a trade using a bullish order block and set your target at an FVG resistance level.

Alternatively, some traders may opt to scalp trades off a single CHOCH on lower time frames, while others might wait for multiple concepts to align on a higher timeframe for more confirmation.

The key advantage of SMC is its adaptability. You don’t need to apply every concept at once, but when several concepts do align – such as an order block, FVG, and CHOCH all indicating the same trend – your confidence in the trade can significantly increase.

The more concepts that stack up in the same direction, the stronger the trade setup becomes.

Ultimately, it’s up to you as the trader to figure out which concepts and combinations work best for your unique strategy, the asset you’re trading, and the timeframe you’re focusing on.

Let’s dive into a few ways you could approach SMC in your trading.

Trade Strategy #1: Order Block and FVG Combo

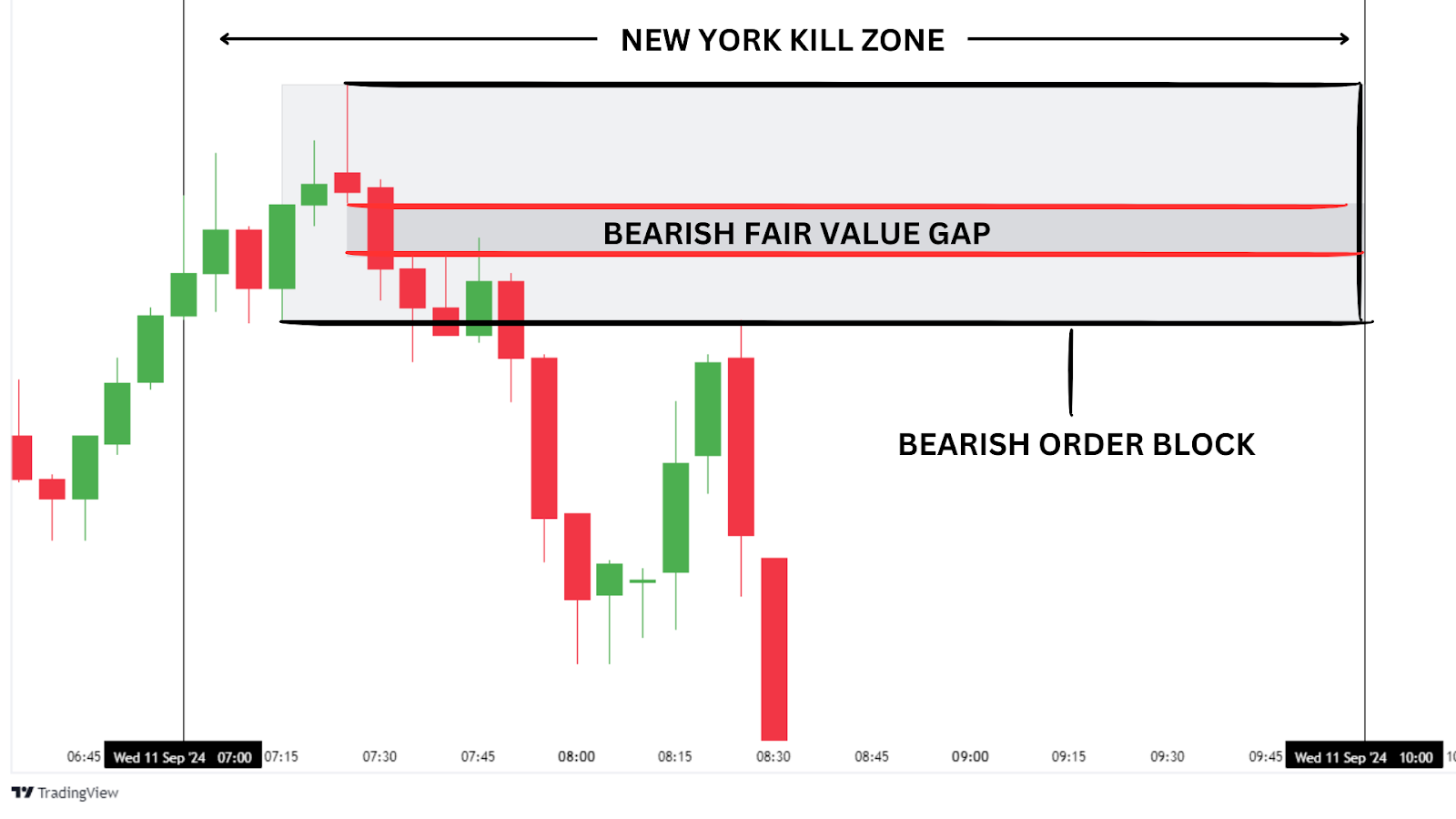

For this strategy, we’ll combine a bearish order block and a Fair Value Gap (FVG) to enter a high-probability short trade.

Using EUR/USD on the 5-minute chart from September 11th, 2024, we’ll see how Smart Money Concepts (SMC) align to provide precise trade entries during key market hours.

On this day, within the New York kill zone, we observe an aggressive price drop that creates a bearish order block. This order block is created as price sweeps the liquidity above recent highs, forming a strong confluence area for a short trade.

Further strengthening our bearish bias, a Fair Value Gap (FVG) is found inside the order block, offering a perfect spot for a short entry as price retraces.

If we zoom out, we also notice something really interesting… Our order block has swept the London Kill Zone’s (and current daily) highs – absorbing even more liquidity, but also failing to close above. This is an added confirmation for our short bias, selling the narrative that Smart Money has pushed prices higher in order to sell with bigger volume.

Steps for the Trade:

- Entry: As the price retraces into the FVG within the bearish order block, we set a sell limit order at the middle of the FVG. This is where the imbalance is most likely to be filled.

- Stop-Loss: Place your stop-loss just above the high of the bearish order block, minimising risk while allowing enough room for the trade to play out.

- Take-Profit: Target the nearest swing low, which aligns with a liquidity pool where retail stop-losses are likely to be clustered. Remember how Institutional traders often aim for these levels to target retail liquidity.

Within the New York Kill Zone, our take profit is hit by an aggressive 5-minute candle, which offers an impressive 1:3 risk-to-reward (RR).

Trading Strategy Summary:

- Entry Point: Enter a short position at the FVG within the bearish order block on the 5-minute chart during the New York kill zone (8:00 AM – 10:00 AM UTC-4).

- Stop-Loss: Place your stop-loss just above the high of the order block to protect your capital.

- Profit Target: Set your take-profit at the nearest untested swing low, where institutional traders are likely targeting liquidity.

| PROS: Utilises multiple SMC tools (Order Block + FVG), offers high-probability setups during volatile kill zones and provides excellent risk management. |

| CONS: If volatility increases beyond expected levels, it may trigger early stop-losses, requiring a good understanding of kill zones and liquidity flows. |

Trade Strategy #2: Fibonacci and FVG Entry Model

This strategy shows how Smart Money Concepts (SMC) can be paired with traditional trading tools, like the Fibonacci retracement, to create a simple but effective entry model.

In this example, we’ll use the EUR/USD 4-hour chart on August 5th, 2024, to demonstrate how a Fair Value Gap (FVG) aligns perfectly with a key Fibonacci level, setting up a high-probability trade.

In higher time frames like the 4-hour, kill zones aren’t as critical.

However, it’s often interesting to see how limit orders, stop losses, or take profits get triggered within these kill zones – something to keep in mind for future analysis.

We’re in a macro bullish market on EUR/USD. After a brief down move, the market forms a swing low and then aggressively trades upward, taking out the recent high and creating a new higher high. This is our signal to draw the Fibonacci tool.

Steps to Execute the Trade:

- Fibonacci Placement: Place the Fibonacci tool using the recent swing low as the 0 level and the new higher high as the 1 level. We will be focusing on the 0.5 level for our entry.

- Fair Value Gap (FVG): As price retraces, we notice the 0.5 Fibonacci level lines up perfectly with a large FVG. This gives us a strong confluence area for a bullish entry.

- Entry: Set a limit buy order at the Fair Value Gap, ensuring it’s at or below the 0.5 Fibonacci retracement level. This is crucial—your entry should remain within the “bearish half” of the Fibonacci retracement, below the 0.5 level, where institutions are likely to enter orders.

- Stop-Loss: Place your stop-loss below the swing low (the 0 Fibonacci level) to minimise risk.

- Take-Profit: Target a fixed 2RR, doubling your risk with a profit target based on recent swing levels.

In a few days, our take profit is hit, for an excellent swing trade profiting 1:2 risk-to-reward (RR). Notice how we were filled almost to the tick, and didn’t have to withstand any drawdown!

Trading Strategy Summary:

- Entry Point: Enter a long position when the price retraces into the FVG, aligning with the 0.5 Fibonacci retracement level in a macro bullish market.

- Stop-Loss: Place your stop-loss below the swing low or 0 Fibonacci level, ensuring your risk is controlled.

- Profit Target: Aim for a 2RR fixed target, which allows for a balanced approach to risk/reward.

| PROS: Combines Fibonacci and FVG for a double layer of confluence, works well in trending markets, provides clear entry, stop-loss, and profit target. |

| CONS: May produce fewer setups in choppy markets; if the FVG doesn’t align with the Fibonacci retracement, the trade may lose its edge. |

Closing Thoughts on Smart Money Concepts

Smart Money Concepts (SMC) offer retail traders valuable insights into how institutional players manipulate the market. By mastering key SMC principles like liquidity pools, order blocks, and fair value gaps, traders can align their strategies with the “smart money” and make more informed decisions.

However, it’s important to remember that SMC is not foolproof and requires patience, discipline, and continuous learning.

Advantages of Being an SMC Trader

- Increased Market Insight: You gain a deeper understanding of how institutions move the market and manipulate liquidity.

- Predictive Edge: SMC provides a framework for predicting price reversals and key market moves based on institutional footprints.

- Informed Trading Decisions: With SMC, you learn to avoid common retail traps and place your trades with smart money.

Disadvantages of Being an SMC Trader

- Complexity: SMC can be overwhelming for beginners, with its advanced concepts requiring significant time to master.

- Uncertainty: SMC is not always a guaranteed strategy, and institutional traders can still outmanoeuvre even well-informed retail traders.

- Emotional Toll: Trading against the trend or waiting for ideal SMC setups can be mentally challenging and require strong discipline.

FAQs

What is a Smart Money Concept (SMC) in Forex Trading?

A Smart Money Concept (SMC) refers to any trading strategy based on how institutional traders, or “smart money,” manipulate liquidity and market structure. SMC Forex trading helps retail traders align their strategies with the market moves of major players like banks and hedge funds. By using SMC, traders can identify key areas like order blocks, fair value gaps, and liquidity pools to make more informed trading decisions.

How does SMC help traders understand market sentiment?

Smart Money Concepts trading offers insights into market sentiment by revealing where institutional traders are likely to enter and exit positions. By studying liquidity pools, fair value gaps, and breaks in market structure, SMC Forex trading allows traders to anticipate shifts in market sentiment, helping them to trade more effectively alongside the “smart money.”

What is a Fair Value Gap in Smart Money Concepts?

A Fair Value Gap (FVG) in Smart Money Concepts refers to a gap in liquidity on a price chart where institutional traders step in to rebalance the market. FVGs signal imbalances between buyers and sellers, often offering traders opportunities to enter trades as the market fills these gaps. They are a key element in SMC forex trading strategies.

How can I use Smart Money Concepts in my trading strategy?

Smart Money Concepts can enhance your trading strategy by focusing on institutional trading behaviours such as market structure shifts, liquidity grabs, and fair value gaps. SMC Forex trading strategies often aim to follow the moves of institutional players, allowing retail traders to improve their entries and exits based on these smart money insights.

How does Smart Money Concepts align with market structure?

Smart Money Concepts revolve around market structure, with a focus on breaks of structure (BOS) and changes of character (CHOCH) to signal trends and reversals. By understanding these shifts in market structure, SMC traders can anticipate when institutions will step in to create or drain liquidity, making it a vital component of successful Forex market trading.

What is the role of market makers in price action trading?

Market makers play a crucial role in price action trading by providing liquidity to the market. They facilitate trades by matching buy and sell orders, often influencing short-term price movements. For traders focused on tracking smart money, understanding how market makers manipulate liquidity is essential. By observing key areas where large orders are placed or withdrawn, traders can align with institutional strategies and refine their price action trading to capture better entry and exit points.